One night last March, Sue Fredericks ran into trouble. She had been watching snow accumulate for hours from her post at a 24-hour gas station. Busy stretches on her overnight shift were rare, on account of the size of the town in which she worked; with a few thousand residents an hour from Indianapolis, it is small and quaint, surrounded by corn and soy fields and featuring a shuttered Walmart. March marked Sue’s eighth month on the job, and she was earning $8 an hour. Around 4 a.m., Sue (who asked that I change her name) consolidated the trash into two bags, propped the door open, and, hands full, walked outside. Somewhere near the dumpster, her foot hit a patch of ice. Sue’s leg flew out from under her, and she landed on her right ankle. “I heard it snap and all,” she said later, but “I didn’t break it to where my bone was sticking out.”

Sue, who at 41 already had arthritis from a lifetime of mostly manual labor jobs, crawled inside, called a co-worker, and asked her to come in. The co-worker arrived at 5 a.m., and Sue, who had kept her sturdy boots on in hopes of holding her bones in place, drove to the house she shares with her friend Robin and Robin’s family on the outskirts of town. She took off her boots, propped herself up on her bed, and waited in the dark. When Robin got up an hour later, Sue asked for her opinion on the ankle; Robin (not her real name) took one look and insisted on going to the emergency room.

A couple of years earlier, Sue had gotten health insurance through the Healthy Indiana Plan, a Medicaid expansion under the Affordable Care Act. HIP represented a political bargain between then-Gov. Mike Pence, who was hostile to public aid, and advocates who worried about the state’s 596,000 uninsured citizens. The program expanded access but required each participant to make a monthly payment—a feature proponents say gives people “skin in the game.” HIP’s architect, a controversial consultant named Seema Verma, went on to advise a half-dozen states about similar programs. In 2016, then President-elect Donald Trump nominated Verma to head the Centers for Medicare & Medicaid Services, the vastly powerful agency that oversees both those programs and their insurance markets. One of her first actions was urging the nation’s governors to impose premiums for Medicaid, charge its low-income recipients extra for emergency room visits, and require recipients to get jobs or job training.

Sue’s experience with HIP offers a preview of how such policies could play out. When HIP first expanded, Sue, single and making about $150 a week after taxes, qualified. She got back on medications for anxiety, depression, arthritis, and emphysema.

Then, in 2017, the state asked Sue to show once again that she was eligible for HIP. Sue took her paperwork to the local social services office, where a worker helped her fax it to headquarters. The state wanted verification of employment, but Sue didn’t have her boss’ signature because her boss was on vacation, so she sent the paperwork without it. When she got a letter saying her HIP had been canceled because she did not prove her income, Sue called the program’s help line. Sue explained to the agent what had happened and asked how to fix it.

“They said I’d have to redo the whole process, and I got frustrated and I told them forget it,” Sue told me last summer in Robin’s living room. Sue, who is short and heavy, was in sweats and a loose fuchsia tank top with the words “Live, Laugh, Love” spelled out in purple lamé. “I get too frustrated, so I just leave it alone. I don’t want to say something I’m going to regret,” she said. When I asked what she meant, she grimaced and looked down: “Cuss ’em out.” Sue never managed to get back on HIP, so when she broke her ankle in 2018 she had no coverage at all. By August, she was facing about $4,000 in medical bills.

Sue’s inability to stay insured is a knotty problem at the heart of the Trump administration’s ambitions to introduce work requirements for every public program aiding the poor in the United States, starting with Medicaid. Conservatives, drawing on the same logic they used to push “workfare” in the 1990s, say requirements will root out fraud and foster self-sufficiency. Opponents say the requirements will make things worse. “Without access to health care, it’s less likely that someone’s going to be able to get a job,” says economist and Clinton-era Labor Secretary Robert Reich. “The whole notion of taking Medicaid away if you don’t have a job is upside-down.”

Missing from the debate—perhaps because there’s hardly been any reporting on the subject—is the fact that work requirements are also a profit center for a rapidly growing private industry. Exhibit A is Maximus, the company that helps run HIP and the bureaucracy that stands between Sue and insurance.

Business processing behemoths like Hewlett-Packard and IBM often run the minutiae of public-benefit paperwork and accounting. Local nonprofits sometimes contract for services like job training and case management. But Maximus does it all, holding contracts for everything from job training to child support enforcement to health care enrollment. In a 2014 business presentation, the company claimed to have a hand in the cases of roughly 59 percent of America’s Medicaid clients. Among companies providing both social programs and paperwork support, it “is likely the largest,” says Daniel Hatcher, a legal scholar at the University of Baltimore and author of The Poverty Industry. Though Maximus is barely known to the taxpayers who underwrite the programs it helps run in 41 states and for multiple cities and counties and the Social Security Administration, as of September 2017 it had nearly $2.5 billion in annual revenue and 20,400 employees on four continents.

Indeed, the company is so interwoven into public benefits at the local, state, and federal levels, Hatcher says, “that they are almost becoming government.” And with the Trump administration gunning to overhaul the American safety net, Maximus is poised to get much bigger.

Maximus was founded in 1975 by David Mastran, a former Air Force researcher who had worked in the Nixon administration, helping to implement fraud controls in Great Society programs. As he notes in his self-published memoir, Privateer!, he “was motivated to help government, not to make a lot of money, but somehow helping government was always financially very rewarding.” Maximus secured the nation’s first privatized welfare contract in 1987, in Los Angeles County. A profile from the Washington Post mentioned the “softly lit, carpeted waiting room” of its welfare office and noted the company had “brought its philosophy of sweetness, light and modern business management to the heart of the American underclass.” According to Mastran, Maximus was known for using data and computers—then a rarity in social services—to root out fraud. By 1990, Maximus claimed revenue of $19 million.

For decades, conservative economists, inspired by libertarian Friedrich von Hayek and free-market ideologue Milton Friedman, had been pushing privatization of social services. The Reagan administration vilified black “welfare queens” so as to cut benefits. But it was Bill Clinton who brought the two trends together to launch “the boldest privatization agenda put forth by any American President to date,” Ronald Utt, then a senior fellow at the conservative Heritage Foundation, wrote in 1997.

Clinton’s pledge to “end welfare as we know it” became “an all-purpose elixir” on the 1992 campaign trail, wrote Jason DeParle, a New York Times reporter who covered welfare reform. In that phrase, conservatives heard a promise to end the government’s pledge to help the poor. Racists heard a nod to David Duke, the Ku Klux Klan leader whose prominent run for Louisiana governor had featured promises to reduce welfare by implanting poor women with the contraceptive Norplant. But the caveat of “as we know it” also allowed liberals to hear a promise for programs more robust than just cash assistance, particularly child care, and encouraged recipients to hope a system that policed their home lives and punished them for getting jobs might improve.

As workfare programs began to sprout up nationwide, Maximus capitalized on the doublespeak. The big payoff came when Clinton signed welfare reform into law with the Personal Responsibility and Work Opportunity Reconciliation Act in 1996. Welfare agencies told clients to start looking for employment if they wanted to keep cash assistance; if they couldn’t find a job, the state would try to give them work to do. Sue, then a young, single mother, first went on welfare that year.

The following year, Maximus went public, posted revenue of $128 million, and told investors that far greater profits were to be found in the social safety net. In its annual report, Maximus laid out its targets: 6.5 million people on Supplemental Security Income (which goes mostly to people with disabilities), requiring $2 billion in administrative spending a year, and 28 million people on food stamps at $3.7 billion in overhead. Between those, plus Medicaid, welfare, disability assistance, and child support, Maximus was eyeing a $21 billion market serving about 100 million people.

Maximus grew fast. It developed welfare-to-work programs, from hiring caseworkers to designing metrics to assess those workers and get them paid. It devised ways of managing child support enforcement, consulted with governments on cost-cutting measures, and dipped its toe into prison services. It ran contracts in Africa and Latin America and for the World Bank and the US Agency for International Development, and it oversaw workforce programs in Israel and Australia. Mastran built on the lesson he’d learned in the Nixon administration—that programs claiming to reduce fraud were an easy sell across the political spectrum. “We got more business from the Democrats” than the Republicans, says Mastran, who now runs an educational software company in Nashville. A decade after welfare reform was first rolled out, Maximus had annual revenue of $701 million.

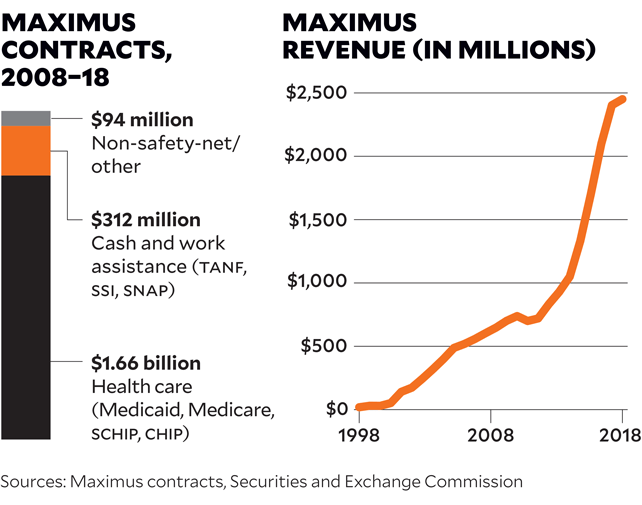

The last decade has been even better to Maximus. The Affordable Care Act—particularly the complex eligibility rules for subsidies that Republicans demanded—created a rich new market. Last summer, Mother Jones requested the company’s contracts from the federal government, all 50 states, the District of Columbia, and New York City. Of those 53 governments, 44 provided a total of 180 contracts—and 392 amendments and renewals—under which Maximus or its subsidiaries had worked since 2008.

Across the contracts we assessed, the bulk of Maximus’ work has been in managing access to means-tested health care programs like Medicaid and the Children’s Health Insurance Program. In the last decade, Maximus has contracted for this kind of work in 28 states and Washington, DC, earning $1.7 billion. The company has also helped run cash and work assistance programs across 21 states, New York City, and the federal government; those contracts totaled $312 million for welfare-to-work, disability, and child support collection. Nearly all of Maximus’ work is in a handful of states—megacontracts in Michigan and Texas account for 46 percent of its contract values, and commitments in Iowa, Indiana, Kansas, Pennsylvania, and Tennessee account for 27 percent more. But the scale of Maximus’ activities is so large that contracts with the 37 other governments, representing just 27 percent of its overall revenue, amount to more than $557 million. Even this is an undercount; eight states provided at least one document indicating a relationship with Maximus without noting the contract value.

Maximus has faced its share of controversies. Wisconsin was among the first states to contract with Maximus to run welfare-to-work programs in the 1990s, but the company was criticized for spending taxpayer money intended for the poor on marketing materials and workfare programs in other states. After Jason Turner, an architect of Wisconsin’s welfare overhaul, was hired by New York City Mayor Rudolph Giuliani, Maximus consultants met with New York City welfare officials months before new contracts were even put out for bid. Maximus was initially awarded $104 million out of nearly $500 million in welfare-to-work contracts there. The city’s comptroller rejected the deal based on what he described as “corruption, favoritism, and cronyism.” (A court upheld the contract; Mayor Michael Bloomberg let it quietly expire.) And of course the biggest potential conflict is Seema Verma, the current head of the federal Centers for Medicare & Medicaid Services, who has long-standing ties to the company. During her confirmation hearings in 2017, her consulting firm still held a $10,000 contract with Maximus.

For states that have decided to teach the poor a lesson about responsibility, Maximus is a popular partner. A webinar in December 2017 featured Michigan’s acting Medicaid director, Kathy Stiffler, who spoke glowingly of Maximus’ work in that state, where it serves as an enrollment broker for Medicaid. The state also persuaded its Medicaid insurers to contract with Maximus to help manage clients’ premium contributions, said Stiffler; the company is so trusted by the state that its officials meet with insurers without state representatives present. Indeed, when Maximus bids on contracts, its proposals include letters of reference from state governments happy with its work. In a 2016 bid for a Medicaid enrollment broker contract in Wyoming, four states—Illinois, Indiana, Iowa, and Virginia—offered letters of support. Indiana called Maximus “a valued partner.” The other three states all noted, verbatim, that its “staff” and “work ethic…go above and beyond.”

The core of Maximus’ pitch to governments is that it can save money, usually by ensuring that only those truly entitled to benefits receive them. Company representatives cite its 2013 work in Illinois as a prime example. That year, Maximus audited the state’s Medicaid rolls and found that 41 percent of clients had died or moved out of state or were no longer income-eligible. By purging those clients from the rolls, Maximus says it saved the state more than $200 million a year. “Maximus is proud of our work to bring efficiency and accountability to government services, to improve delivery quality for recipients and to save money for taxpayers across the country,” Lisa Miles, the senior vice president for corporate communications, said in a written statement. (Maximus declined to answer a list of questions from Mother Jones for this story.)

Those savings were hotly contested, though, as was the quality of Maximus’ performance. The Illinois work involved a $77 million contract with Maximus, and the American Federation of State, County and Municipal Employees sued the state to cancel the project, arguing that the job should have been handled by agency employees for $18 million less. Meanwhile, Maximus’ early work on the contract was so poor that state officials withheld payments for the first four months. An arbitrator agreed with AFSCME and ordered the state to cancel Maximus’ contract.

Maximus also argues that it does not make policy; it merely follows the rules set out by the government and tries to implement them efficiently. Yet, the company’s track record suggests that the bureaucracy it helps enforce can lead to perverse outcomes, as in a 2005 case in Maryland, where Maximus took over child support collection for the state. There, the company sued a single father caring for his four kids, who were born to two mothers; one mother had died, and the other had abandoned her children. The father, a landscaper for the city of Baltimore, had owed child support before he became their caretaker. Maximus sued the father, who was supporting his family on $10.96 an hour, for about $10,000. The state head of child support asked Maximus to desist, suggesting that the lawsuit was against the best interests of the children, but the company refused and pursued the case.

More recently, Maximus’ work for a $108 million Medicaid enrollment contract in Kansas came under fire because of interminable backlogs that prevented low-income residents from getting care. State officials said Maximus had intentionally lowballed the contract to win it. To make matters worse, assigning the contract to a private company had eroded the state’s capacity to perform the work itself. Without infrastructure to run enrollment for the entire state, Kansas officials agreed to bring the most difficult cases in-house—and to extend Maximus’ contract so it could do a better job with the rest. A November 2019 report by the Communication Workers of America, which is in the middle of a battle to unionize several thousand Maximus employees, found that children lost health coverage, pharmacies stopped filling prescriptions, and seniors were unable to access the care they needed due to problems at Maximus in Kansas, as well as in Tennessee and Pennsylvania. “In some cases,” Kansas Secretary of Health and Environment Jeff Andersen told the Wichita Eagle, “you get what you pay for.”

Sue did not feel as though anybody had gone “above and beyond” to help her. “I would not recommend or suggest HIP to anybody,” Sue told me. Initially, Sue had a monthly payment of $1 in exchange for her coverage, and she scraped together $12 to pay for a year by money order. When the state canceled Sue’s coverage because of that missing information from her boss, she just gave up—even though she was poor enough to qualify for HIP. She tried to take care of her health on her own. When her depression and anxiety ramped up, Sue ate more. She smoked more cigarettes, which she called her “nerve pills,” and avoided people so she wouldn’t snap at them. When her joints ached, she took ibuprofen and tried to distract herself with housework. To manage the hacking coughs from her emphysema, she rationed her use of a prescribed inhaler.

The restrictions that kept Sue from staying insured—regularly proving her low income, paying a token fee each month—are typically portrayed by their proponents as a means of helping the poor. “It is not compassionate to trap people on government programs,” Verma told a Medicaid conference last September. “True compassion is giving people the tools necessary for self-sufficiency…allowing able-bodied, working-age adults to experience the dignity of a job.” What Verma, like many advocates of work requirements, did not say is that most poor people already work, including 60 percent of Medicaid clients.

It is the same rationale that was used to justify work requirements for cash assistance two decades ago, transforming “welfare as we know it” to Temporary Assistance for Needy Families (TANF), aid that is only available to those who look for work and is limited to five years over a lifetime. Yet, judging from that experience, there’s little evidence that work requirements help people do anything besides give up on getting help. Cash welfare today serves a small share of poor families: Before Clinton’s reforms, more than 60 percent of the families in poverty in Indiana, for example, got cash assistance. By 2016, only 7 percent did. “Adding work requirements to cash assistance has been more about reducing the caseload than it has been about helping parents connect to work,” says Liz Schott, a senior fellow at the Center on Budget and Policy Priorities. “Many, many people are worse off,” she says. A federal study of three cities found that roughly three-quarters of those who left welfare in the late 1990s remained poor. The share of Americans in deep poverty—currently, a family of four living on $1,014 a month or less—has climbed steadily. In 1999, 41 percent of the poor were in deep poverty. By 2016, 45 percent were. And from 1995 to 2012, the share of American children in single-mother households living in extreme poverty—less than $2 a day—increased sixfold.

If restrictions to public aid have yet to reduce poverty and improve people’s lives, what accounts for their enduring political appeal? Social policy historian Linda Gordon says the compulsion to separate the deserving from the undeserving poor has been ingrained in American policies since the country’s founding. The original cash assistance program, Aid to Families With Dependent Children, primarily supported white middle- and upper-class widows in the early 20th century. Segregation and prejudice effectively excluded African Americans from such aid. But as more African Americans gained access to public programs, “the construct of whether the recipients of these benefits were deserving began to change,” says Ibram X. Kendi, director of the Antiracist Research & Policy Center at American University. Today, racist stereotypes about black people “filter into people’s consciousness and compel them to not be supportive of black people seeking public assistance. All of these racist policies primarily harm black people, but they also typically harm everyone,” he says.

Race came up several times in my discussions with Sue. Like nearly three-quarters of people on HIP, as well as the plurality of people using Medicaid and food stamps nationwide, Sue is white. So were most of the people she knew who were getting assistance. Yet when she told me about visiting public benefit offices in Indianapolis earlier in her life, she talked about black people. “You go down there and 90 percent of your black people in Indianapolis are getting $1,500, $2,500 in food stamps. They are getting A-1 insurance, driving around in Bentleys,” she said. When I suggested to Sue that it was unlikely that 9 out of 10 black people in Indianapolis received food stamps, she conceded the point: “I’m not saying it’s just blacks. It’s whites too.” She was also appalled by white manufacturing workers who bought snacks at the gas station with the “$900, $1,000” on their food stamp cards. She had food stamps too, but only $15 a month.

Sue took pride in herself as a “hardworking woman.” She said she had spent five years receiving benefits without working, when her daughters were small. When I asked how that was different from the people at the welfare office, she looked off to the side. “It’s not different,” she said finally. I got the sense that she was ashamed to have needed help—and she resented people who, in her mind, took it without shame. It came out most strongly when she talked about black people, but she would direct it at anyone, including herself. “I’m a 42-year-old woman that lives with somebody,” she said, nodding at her roommate Robin, her voice flattening. “I could be doing better.”

Sue told me her mother had been a drug addict and her father was an alcoholic. She’d bounced between family in Indiana and Texas until she was eight, when her parents took her to a group home, which delivered its own traumas. She stayed there until she was 12 and then rotated between her parents and extended family. “There’s things that I’ve not said anything to anybody about because I’m ashamed,” she told me. “I was molested when I was younger. That’s how I lost my virginity.” When Sue talks about this period of her life, her eyes drop, her face goes blank, and her voice, turned raspy by the cigarettes she started smoking at 13, is a monotone.

When Sue was 16, her mother’s epilepsy became so intense that she dropped out of 10th grade to help care for her. Sue worked odd jobs that didn’t penalize her for her lack of a diploma, things like housekeeping and roofing, and eventually had two daughters. She mostly steered clear of drugs, she said, but when her father died, she fell into a depression and spent “a month, maybe two,” smoking crack; she was ashamed of this, too, but proud that she’d spent the last 13 years clean. “I’ll do without before I ask for anything. I don’t like getting insurance through welfare. I’d rather go out there and bust my ass and get a job,” she said, her voice swelling. Then it flattened. “But sometimes you need the help.”

Sue’s quickness to equate black people with fraud is racist, but this does not make her unusual. Journalists covering poverty have also long reflected racist assumptions about their subjects. One study, which looked at issues of three weekly magazines from 1950 to 1992, found that pictures accompanying stories on poverty featured African American subjects 53 percent of the time, nearly twice their actual share of the poor. African Americans were also the most common subjects in stories of welfare fraud. Nonblacks, most of whom were white, constituted 71 percent of the poor and were the subjects of 47 percent of those stories, usually neutral articles about efforts to fight poverty. The divide has narrowed, but it is still substantial. This coverage has shaped what Americans think of the poor, of public benefits, and most of all of “welfare.” Today, 44 percent of whites without a college degree believe that people on welfare would rather stay on the program than work; so do 35 percent of nonwhites and 25 percent of college-educated whites.

Whatever their provenance or intent, the restrictions of the HIP program have bedeviled Sue, who despite being poor enough to qualify for help under federal law has rarely managed to keep up with the additional requirements imposed by Indiana. She complained to me that doctors were still sending her bills for the broken ankle, even though she was now insured. She had thought HIP would be retroactive for three months, but that was a provision of an earlier version of Medicaid that hadn’t carried over into HIP. As soon as she broke her ankle, she’d reapplied for HIP, but her coverage did not begin again for a couple of months. By then, she says, her medical bills related to the ankle were nearly $4,000.

Without the promise of coverage for her outstanding bills, Sue didn’t see the point in paying HIP. That was doubly true in July, when she lost her job at the gas station after taking a week off to visit family. “HIP’s supposed to be there for people that can’t afford insurance,” she said. The $20 a month the state now charged her, more than she’d paid for a year’s worth of insurance before, felt like too much to spend on something she might not need. Then she added, “If I got to pay out all this money to HIP, I might as well pay the doctor.”

When I mentioned that the HIP program would soon have work requirements, Sue told me it sounded like a good idea. Then she realized what one more requirement would mean in practical terms: paperwork. When she had called the insurance company to make her first payment after breaking her ankle, she said, the representative for the insurer asked for $5, which she paid. She knew her monthly bill should be $20, but she soon received a bill asking for $30. A week later, she got one for $50. So far as Sue could tell, the rate was increasing without reason. “They just keep sending me shit,” she said, visibly frustrated. I looked at the paperwork, and it seemed clear to me that it was because she had not been paying, but Sue did not understand this.

Sue quickly found another job working at a parts supplier for an auto plant 20 miles south of her home. The job involved moving empty totes from pallets to a conveyor belt, did not require a high school diploma, and paid $12.47 an hour. When she learned she’d be eligible for company health insurance after a trial period, Sue looked forward to a future without HIP. “The only way this insurance won’t work out is if I get fired, and I don’t plan on getting fired anytime soon,” she told me. “So I’m good.” Besides, HIP was a hassle. “They don’t explain nothing to you. They give you a bunch of papers to read, and I have a hard time reading,” she said, fidgeting. “I wouldn’t say I’m—I don’t even know the word. I can read and write, but not very good.”

The Trump administration’s plan to expand work requirements across the safety net may open up the largest market of all for Maximus. In November 2017, Verma told the country’s Medicaid directors she would approve waivers that force people getting health coverage to do “community engagement activities”—a.k.a. workfare. This, she said, would give them “hope that they can one day break the chains of generational poverty and no longer need public assistance.” In March 2017, she and Tom Price, then secretary of health and human services, had sent governors a letter encouraging them to adopt work requirements. In January 2018, her agency issued guidelines for proposals. By late 2018, the Centers for Medicare & Medicaid Services had approved work requirements in Kentucky, Arkansas, Indiana, New Hampshire, and Wisconsin.

Even more fundamental changes are afoot. Last spring, Trump issued an executive order outlining “Principles of Economic Mobility.” The order praises the 1996 welfare reform and urges state and federal officials to introduce “work requirements when legally permissible.” But it also uses the term “welfare” to refer to any program “that provides means-tested assistance” or “benefits to people…making less than twice the federal poverty level,” a category that includes about one-third of the population. The order symbolizes Trump’s ambitions to expand the tarnishing effect of “welfare” from the 3.9 million people on cash assistance to the 70.9 million Americans on Medicaid, the 44.2 million receiving supplemental nutrition assistance like WIC and food stamps, and the 9.5 million getting help with housing. But, taken literally, the definition also includes the Affordable Care Act premium subsidies used by 8.2 million Americans, the federal financial aid provided to 2.1 million college students, and the school lunch program that feeds 30 million children.

There is little political appetite for broadening work requirements beyond food stamps, housing, and Medicaid, but the redefinition nonetheless serves political ends, says Liz Schott of the Center on Budget and Policy Priorities. “There’s certainly a lot of politics behind labeling all of these things welfare,” she says, particularly given the racist assumptions often made about public benefit programs. “You call it ‘welfare,’ it sounds like it’s people of color—you can make it something people will attack.”

Indeed, Trump’s order, with its focus on self-sufficiency and fraud prevention, parallels conservative initiatives in the realms of immigration and voting. In September, the administration proposed a change that would prevent any immigrant using Medicaid, housing assistance, or food stamps from getting a green card. It’s “that theme of ‘You may have a right, you may have a benefit, but we’re going to do what we can to make you decide not to use it,’” says Andy Slavitt, an Obama-era Medicaid official who helped implement the Affordable Care Act.

Just as voters in some states are forced to suddenly produce additional identification to vote, all in the name of preventing virtually nonexistent voter fraud, recipients of social welfare are made to jump through hoops to prevent welfare theft that barely happens anyway. The thinking is, “‘We’re giving you these benefits and you’re going to have to work for it,’” says Emory University historian Carol Anderson, whose book One Person, No Vote came out last fall. “It’s the same kind of frame, and a lot of it is targeted at the same people.” The fraud in public aid programs that does exist often benefits providers and business owners more than the poor. One study of five states found that less than 0.2 percent of SNAP food stamp clients double dipped. Nevertheless, 18 states have passed restrictive “stop the scam” policies that expand fraud detection programs.

The difference is that, unlike voter suppression, public benefit suppression can create a significant market opportunity for companies like Maximus. That’s because restricting access to public benefits can be complicated and expensive, even when the restrictions are relatively straightforward, like the monthly fee now required for Medicaid in seven states. Pat Casanova, a consultant who once served as Indiana’s Medicaid director, cautioned in the 2017 webinar that there’s “no way to do a program like this without having it be very, very complex.” After Arkansas introduced Medicaid premiums in 2015, touted by Gov. Asa Hutchinson as a way “to encourage personal responsibility,” the state signed a $9 million contract with a private company (not Maximus) to collect the payments from the 50,000 people subject to them. The payoff could have been significant, says Joseph Thompson, who studied the program for the Arkansas Center for Health Improvement: “If you have 60,000 or 70,000 people paying in every month, that’s going to get you to $10 million a year,” he says. But there was no penalty for failing to pay, and after 18 months the state had received just $426,000 worth of premiums. For every $1 the contractor collected from clients, it earned $21.

Work requirements are even more complex to track than payments. Proving that someone has worked involves regular verification of employment, hours on the job, and sometimes even wages earned; exemptions to the rule make it even tougher to track. If you’re a government agency thinking of adding work requirements, “you’re thinking, ‘Oh, my God. What kind of computer system would be required to keep these sorts of records about individual people?’” says Ron Haskins, a Republican who helped write the 1990s welfare reform law. But for the company that maintains that system, the payoff can be huge. TANF, the program that helped put Maximus on the path to becoming a billion-dollar company, has a total annual budget of $31 billion. The combined budgets of the public programs currently targeted for work requirements—food assistance, health care, and housing—total $704 billion.

The more likely outcome of a complicated eligibility system, regardless of who runs it, is that people leave the program, losing insurance and suffering the health effects that will cause. In June, Arkansas became the first state to implement work requirements for its Medicaid clients, spending about $7.6 million to put the policies in place. By November, more than 12,000 Arkansans had lost their insurance, and another 6,002 were in danger of losing it by December. In October, of the 69,041 clients subject to work requirements, nearly all were either already working or met exemption criteria. Only 401 reported new employment—less than 1 percent. “Nobody’s getting help getting a job; people are losing coverage,” says Joan Alker, executive director of the Center for Children and Families at Georgetown University.

Whatever politicians may claim about promoting work, says Slavitt, the Obama-era Medicaid official, “these are money-saving ideas. That’s why states are trying to do this, to decrease Medicaid enrollment.” But those savings can be illusory, he says, because uninsured people often skip preventive care and get sicker, which eventually costs society more than it would have to insure them.

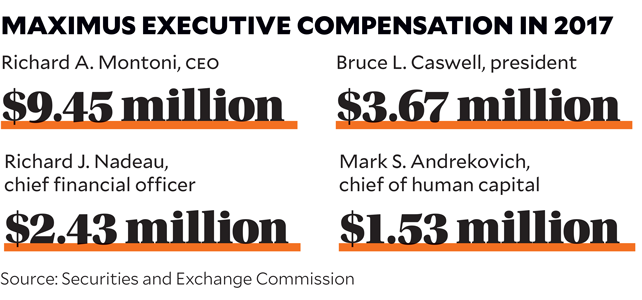

But Maximus knows a market opportunity when it sees one. When the company held its quarterly conference call for investors last May, an analyst questioned whether a stronger economy would weaken the market for Maximus, since it deals in programs aimed at the poor. Not at all, said Bruce Caswell, who took over last April as CEO, a position whose last occupant earned $9.5 million a year. He added, “The movement to add work requirements—it’s a competency that no other company in the market has like Maximus.”

For nearly everyone associated with health care in America, paperwork is the cost of doing business, not the business itself. This is true for insurers, which may use bureaucracy to discourage patients from using costly care but do not profit directly from paperwork, per se. For companies like Maximus, it is different; the paperwork standing between people and public aid equals profit.

Maximus’ work in Indiana, where it has run the state’s enrollment brokerage for Medicaid since 2008, is a case in point. The company was key in implementing the HIP program designed by Verma. Then, in late 2017, Maximus signed a $36 million contract with Indiana to also run the state’s employment and training programs for food stamps and welfare, along with a voluntary work program for Medicaid clients called Gateway to Work. In all these contracts, the core function remains the same: to police people’s access to programs for which they have already qualified by virtue of being poor.

Take Maximus’ current $10 million, five-year contract as Indiana’s Medicaid enrollment broker. The state determines whether someone is eligible for coverage and marks their status in a database, which is sent to Maximus, which mails out letters telling people they are now enrolled and should call the help line, which it runs, or use a website to pick an insurer. One of the help line’s primary functions is to help people choose between Indiana’s four insurers, but agency materials also list it as a number for getting assistance with HIP. This makes it an obvious first call when clients have problems with the program, and it is where Sue turned when her insurance was initially canceled. The language of Maximus’ contract suggests this is part of its job, requiring that 85 percent “of all issues from callers should be resolved on the call.” But as a broker, Maximus cannot access details about clients’ cases or insurance, and it has little power to do more than refer clients to state agencies and insurers if they need help beyond choosing an insurer. As far as the state is concerned, says Marni Lemons, a spokeswoman for Indiana’s Family and Social Services Administration, the “resolution” only requires Maximus to make the proper referral—not to fix the client’s problem. In other words, Lemons wrote in an email, “when a client calls with an inquiry, it is often answered appropriately, but the customer is not necessarily ‘satisfied’ with the answer.”

This subcontracting of responsibility has yielded a confusing system, even for professionals. Amanda Hall, an attorney with Indiana Legal Services, told me about a time when she called the help line on behalf of a client. The woman who answered, says Hall, told her, “‘Well, you’ll have to contact the state.’ I was like, ‘I thought I was.’” Hall asked who to call at the state, but according to Hall, the agent replied there was no number she could share.

Maximus’ work in the state’s employment and training programs similarly rewards the company for managing bureaucracy regardless of whether it actually helps people. In late 2017, Maximus signed a $36 million contract to run Indiana’s work programs for SNAP and cash assistance. In that contract, the company estimates it will see 93,000 clients and earn about $9.1 million each year. But it expects fewer than 200 people annually will find and keep jobs for at least six months. Most of what Maximus earns does not come from moving people into the “self-sufficiency” that Verma and Trump claim is the goal of work requirements. It comes from managing the hurdles placed between the poor and public aid.

As a single adult who doesn’t have children at home and works and has received Medicaid, Sue is a likely candidate for the coming work requirements. If she needs food stamps, she will have to fulfill a work requirement for that benefit via another program administered by Maximus. In both cases, Sue will find herself in the same situation: Whenever she tries to get the assistance she is poor enough to qualify for, the red tape of work requirements will transform her hardship—and the tax dollars set aside to ease it—into profit for Maximus.

Sue told me with pride that she has worked for nearly all her adult life, but I got the sense that keeping a job is not easy for her. The parts supplier job left her in nearly constant pain from spending nine hours a day pacing across a concrete warehouse floor. Then, in early August, the company fired her, explaining that she “didn’t meet the criteria they were looking for,” she said. Sue told me she didn’t know what she’d done wrong.

Helping Sue keep a job is not something Maximus or the state is likely to do. Of the 93,000 clients Maximus expects to see each year under its Indiana contract, it presumes only about 18,400 will appear for an initial orientation. The company earns $6.48 per no-show and $168 for those who do show. If a client succeeds in getting and keeping a job for at least six months, a reasonable proxy for self-sufficiency, Maximus earns $2,402. But Maximus does not expect this to happen often. The contract sets aside just over 1 percent of its payments for the 199 people it expects to stay in a job for six months. (If Maximus’ $9.1 million annual contract only paid for those workers, the cost would be $45,583 apiece.) Nearly 60 percent of its payments are slated to come from the processes that lead to getting people placed in a job, even if they only keep it for a day.

In other words, Maximus is mostly paid to churn people through the system. Maximus earns $56 for each client who completes a skills assessment, $279 for each one who lands a job, $531 more for each one who sticks it out for a month, and another $503 for those who stay for two. Maximus can only claim payments on each client once a year, so it has little incentive to give much help to those who fail quickly. The only way Sue would pay off for Maximus after losing a job within a month, for example, is if she were to repeat the process each year, for a total of three cycles. After Sue’s third round, Maximus would earn $700 more than if she’d kept one job for six months. While Maximus routinely touts its ability to help clients, it’s hard to see how this setup would benefit Sue; it’s easier to see how it makes Maximus money.

“Performance-based contracts” like this can be incredibly advantageous, says Carolyn Heinrich, a government subcontracting expert at Vanderbilt University. “When you say to someone, ‘We’ll pay you for this,’ they’ll figure out how to make that particular thing as big as possible, and sometimes in ways that don’t have anything to do with the longer-term outcomes,” like how long people keep jobs or whether they can get their medications, she says. What’s more, if the contract goes badly, the government will pay the cost of cleaning it up—and be blamed for it too.

Over several reporting trips to Indiana last spring and summer, I spoke to more than two dozen people on Medicaid. Whenever I asked the clients using HIP about Maximus, nobody had heard of it—they all assumed they’d been dealing with state employees. This is perhaps not surprising for enrollment, where clients speak with disembodied workers at call centers. But it is also an easy mistake to make even when meeting Maximus workers face to face. The company runs 52 employment and training offices around the state, and when I visited five in Indianapolis, each bore the sign of IMPACT—Indiana Manpower and Comprehensive Training, the state’s employment services program. All five shared facilities with the local office for state social services, rendering them virtually indistinguishable from government.

When Sue encountered difficulties with HIP, her frustrations were aimed at the program and sometimes the government. But her most consistent target was herself, for failing to keep up with the rules. She had no idea that a company was profiting from her troubles—she didn’t even know its name.

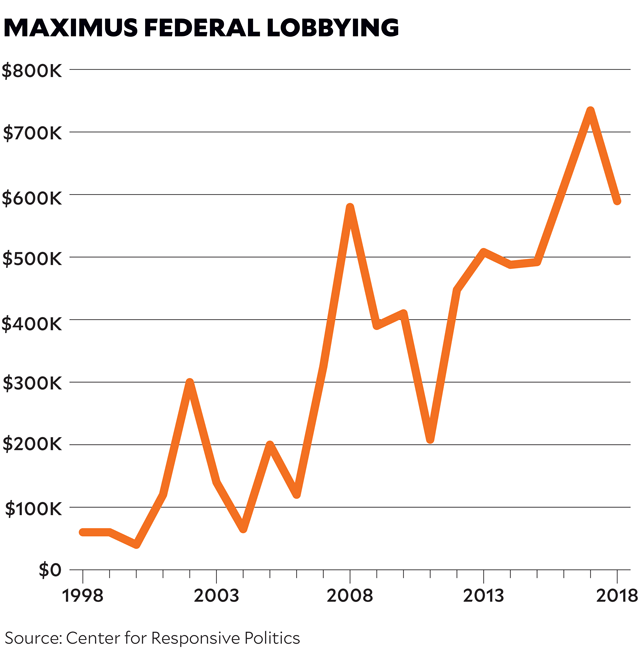

While Maximus’ name is unfamiliar to the people it serves and the public that pays for it, it is better known among lobbyists and politicians. In the last decade, Maximus has spent $5.5 million on lobbying in Washington, DC, and its political action committee has dribbled nearly $270,000 to political races across the country. Maximus has also spent steadily at local levels, especially in states seeking to institute work requirements. Since 2015, it has allocated more than $153,000 to lobby Kentucky officials and just less than $135,000 to lobby officials in New Hampshire.

Not all states track lobbying, but in seven states we examined where Maximus has significant contracts, lobbyists reported that Maximus had paid them at least $5.5 million since 2008. Lobbyists in New York state, for which we only have partial contract data, reported that Maximus had spent $1.7 million there over the same period. At a minimum, Maximus spends more than $1 million each year to persuade political leaders to pay it more money to police the poor.

By mid-August, Sue had found herself another job, spending 32 hours a week sanding auto parts at a different auto supplier. That job had no health benefits, so she called the help line several more times to try to sort it out. “They just keep giving me the runaround,” she told me. “I can’t get a straight answer from nobody.” Her weekly checks came out to $250, give or take, and once she paid rent and bought food and “female things,” she hardly had anything left. She kept looking for another job. By fall, she’d succeeded and was working in a parts warehouse six days a week, earning $11 an hour. The job came with health insurance, and she was glad for a life without HIP. If the job sticks, she’ll also avoid the new work requirements for Medicaid. But if Sue finds herself in need again, new calls and paperwork and Maximus await.

This article has been updated.

This article was reported in partnership with the Wayne Barrett Project at the Investigative Fund.

Mother Jones wants to hear from you: Are you at risk of losing your health insurance because your state wants to implement Medicaid work requirements? Have you recently lost coverage? Let us know in the form below, send us an email at talk@motherjones.com, or leave us a voicemail at (510) 519-MOJO. We may use some of your responses for a follow-up story.